On December 15, 2021, the 2021 Fifth Voice of China Automotive Customer (VOC+) symposium as well as the award ceremony was held online. Jointly organized by Car Quality Network and Car Research, the symposium is themed as “Inspire creativity & grasp essence”. Nearly 100 representatives from auto associations, domestic first-class auto enterprises, transnational corporations and more than 30 mainstream media gathered online to witness the release of several annual and subject research results and the honor moment of top automakers.

In 2021, China’s auto market suppressed by the pandemic was gradually released. Although the the virus has kept resurging in some areas, under the circumstance that the overall situation has been steadily controlled, the positive return of China’s auto market is accelerating. What synchronizes with the car market is the popularity speed of new intelligent connected vehicles. From January to September this year, the rate of factory-installed standard configuration of the intelligent connected product has been rising all the way, and the monthly rate exceeded 10% for the first time in September, which is only the tip of the iceberg, though, for new vehicles need to evolve continuously in the intelligent era. For automobile companies, the supply of new services is no less difficult than the iteration of their products.

As Tang Weiguo, chairman and president of Car Quality and Car Research, said in his speech, while automobile product is being redefined in the intelligent era, enterprises are in the need of exploration for brand-new customer relations, especially from the perspective of service. He believes that the “Customer-oriented enterprise” strategy employed by the leading brands in start ups played an important role in the early days of going public, but it will take time to see whether it is suitable for large-scale operation and what follow-up effects it will bring to many enterprises. Tang suggested, “Enterprises had better not blindly pursue the concept of “Customer-oriented enterprise”. Tight grasp of the essence of after-sales service is what they really need to do, and this is also how the theme of this symposium is produced.”

The judgment of being cautious about the “Customer-oriented enterprise” strategy comes from the deep digging out of accurate sample data. Tang said that the platform of Car Quality Network has received nearly 100,000 valid complaints in 2021 as of the meeting, the growth of which is, frankly, not a good thing for China’s auto industry but the new data shown in the complaints will provide more inspiration and more effective guidance for judging the trend.

Since 2017, the release of a number of annual and thematic research results has been one of the highlights of the VOC+ symposium. At the fifth symposium, the organizer continued to release high-quality research results of the year 2021 such as real-name customer complaints, customer complaint mitigation, customer satisfaction with auto brands’ after-sales service and annual hot spots research, etc.

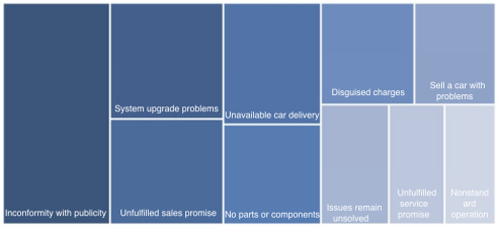

According to the 2021 China Automobile Real-Name Customer Complaint Analysis Report, domestic automobile complaints mainly show the following characteristics:

From 2010 to 2021, the number of valid complaints filed on www.12365auto.com

Complaints about product quality account for a large proportion and the number of complaints about the issue “audio system failure” ranks first.

Some issues have become new growth points of service complaints, such as service problems caused by the popularity of intelligent configuration and a long car delivery cycle resulting from the insufficient supply of OTA and chips.

Throughout the auto market in the intelligent era and post-pandemic era, auto enterprises pay more attention to the role of the third party in the construction of their new relationship with customers.

There are several findings shown below in the 2021 Research Report on the Complaint Behavior of Chinese Passenger Car Users:

In 2021, China Customer Complaint Mitigation Index (CCRI) is 410 (industry average value), lower than 2020, the CCRI of self-owned and joint venture brands dropped, while luxury brands experienced a slight increase;

Customers didn’t get good feedback when complaining through the channels of auto enterprises and dealers, and those who lead complaining expanded their complaining channel in a wide range, which should be focused on.

Customers are less satisfied with the maintenance quality and the time taken to solve problems after their complaints.

The research of vertical field and user attributes has become an important logic to analyze the characteristics of customer complaints.

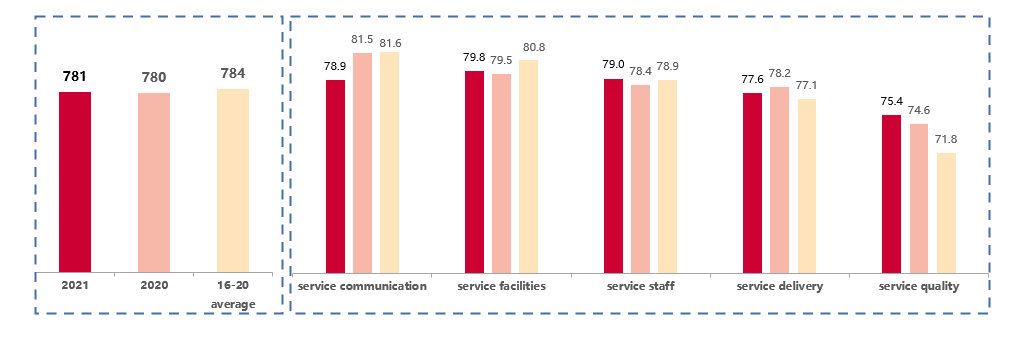

When it comes to after-sales service, we can find in the 2021 China Passenger Car After-sales Service Satisfaction Research Report that:

The industry average level of China’s passenger car after-sales service satisfaction in 2021 is 781 points, slightly higher than that in 2020. Luxury brands got higher scores than self-owned brands, and joint venture brands ranked the last;

Technical capability needs to be taken as the emphasis to make improvement, and the implementation rate of completing one-time repair or maintenance decreased by 4.7% compared to that of 2020.

Customers pay attention to a greater scope of items after entering the stores. One of the changes is that some customers started to be interested in the transparent workshop.

It is suggested in the Moderation and Risk Control of User Experience in the Era of Intelligence that brands should combine their own resources and the strong needs of users to provide them with differentiated experience.

In the age of intelligence, automotive product, though redefined, still takes safety and quality as the basis;

With digitalization, the distance between brands and their customers is shortened, and the new customer relation is more complex and sensitive. The structure, system and talents reserve of traditional auto enterprises are the difficulties in the process of constructing new customer relation,which needs to be paid more attention to;

When interacting with existing customers and target customers, traditional auto enterprises should activate online and offline resources to formulate differentiated strategies according to multi-dimensional factors such as models and targeted audience.

Most traditional auto companies need to learn that the cornerstone of the construction of an online user management team is “integrity and transparency”.

Car Research offered a suggestion: user needs in new service scenes need to be carefully evaluated to meet strong needs and increase the stickiness of online service.

After the release of these findings, the host revealed the ownership of the awards of VOC+ in 2021. SAIC passenger car won the Outstanding Contribution Award; the winners of after-sales service benchmark brands include BYD, Chang’an Automobile, Chang’an Ford Mazda, Dongfeng Peugeot, Dongfeng Sokon, Dongfeng Citroen, GTMC, GAC Honda Automobile, Geely, LYNK&CO, SAIC Maxus, SAIC-GM-Wuling, SAIC General Motors, SAIC Volkswagen, FAW-Volkswagen Jetta (listed in no particular order).

As for winners in after-sales service satisfaction, SAIC passenger car Roewe ranks the first among self-owned brands, GAC Honda Automobile the first among joint venture brands, and SAIC GM Cadillac the first among luxury brands.

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission