As Xpeng released its financial results on the night of March 17, the other members of “Wei Xiao Li (NIO, XPeng, and Li Auto)”, the first echelon of emerging automakers, followed by revealing their 2022 fiscal reports.

The financial reports indicated that NIO, XPeng, and Li Auto are troubled by the same problems: no profits despite long establishment and continued loss caused by hefty R&D investment and marketing spending. NIO lost 14.4 billion yuan in the whole year, XPing 9.1 billion yuan and Li Auto more than 2 billion yuan. Their loss totaled more than 25.5 billion yuan, 1.8 times as much as that of 2021.

Even though they’ve been leading the NEV market, they still give rise to controversies.

“More sales, more loss” predicament

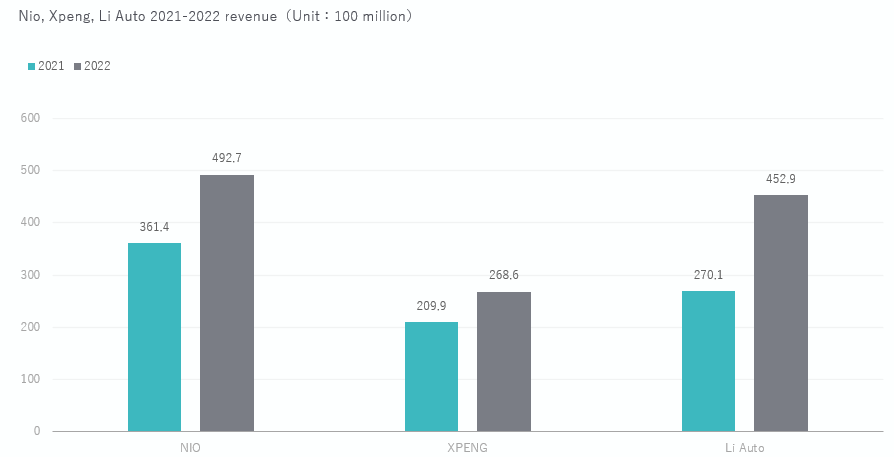

According to the financial reports, the rapid expansion of sales scale drove a significant increase in revenue. NIO, XPeng, and Li Auto achieved varying degrees of growth in revenue, with NIO’s revenue scale being the largest at 49.27 billion yuan, rising by 36.3% year-on-year; Li and Xiaopeng’s were 45.29 billion yuan and 26.8 billion yuan, rising by 67.7% and 27.9% respectively. Their scales were expanded, so were the losses: the predicament of “more sales, more loss” still haunts them.

Date reference :company financial reports. Mapping:Car Insight

Date reference :company financial reports. Mapping:Car Insight

NIO sustained the heaviest net loss. 2022 saw the brand suffer from price hikes of raw material, chip lack, and supply chain disruption. At the same time, the company stretched its resources in the construction of replacement stations/charging piles, the development of new models, the planning of new brands and the layout of new businesses. For example, sub-brands such as “Alpine” and “Firefly” as well as self-developed chips, batteries and even cell phones entailed significant investment.

In 2022, the cut-off of Li ONE put the company under great public pressure. After Li started the delivery of L9 and L8 one after another in September and November, L9 did not achieve the desired sales to increase the gross margin. In other words, it reduced net profit in Q4 2022 and impaired the overall financial performance.

XPeng’s sales continued to shrink since the second half of 2022. The P7 was a hit and contributed a lot in sales, while the newly launched XPeng G9 suffered a “Waterloo” after its introduction.

Date reference :company financial reports. Mapping:Car Insight

Date reference :company financial reports. Mapping:Car Insight

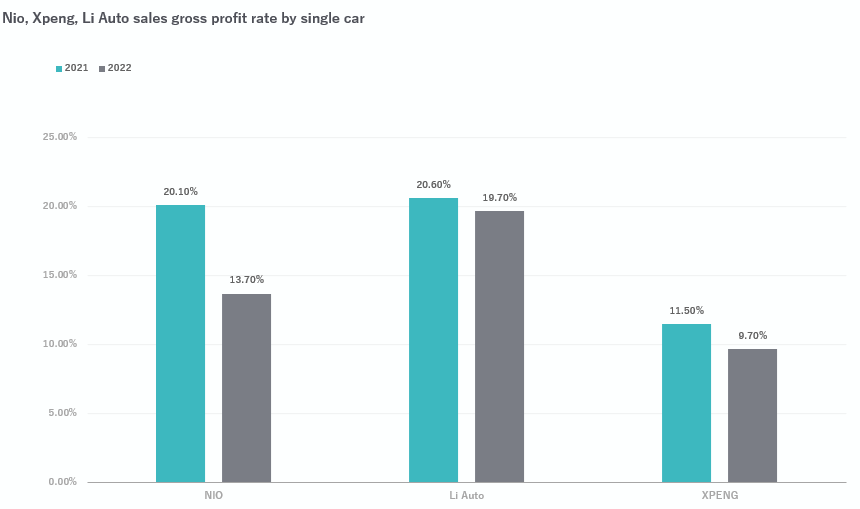

As for profit structure, both NIO and Li Auto achieved a revenue of more than 40 billion yuan, while XPeng’s revenue was less than 30 billion yuan with a loss of more than 9.14 billion yuan, which is 2.4 times as much as Li Auto’s net loss. On the whole, although XPeng sold the most cars, it was the one making the most losses because there was no room for the gross profit margin; Li Auto’s performed best in gross profit margin (greatest profitability) and was the most “budget-savvy” in terms of investment.

Will the price war go on?

For 2023, NIO, XPeng, and Li Auto present their expected targets.

NIO’s 2023 sales are to double, to around 250,000 vehicles, which means selling more than 20,000 per month; Li plans to reach a sales target of around 300,000 vehicles; XPeng is relatively conservative, with an internal letter hinting at delivering nearly 200,000 vehicles.

Photo credit :by NIO

Photo credit :by NIO

Nevertheless, considering the sales of the first two months,“Wei Xiao Li” all failed to meet their average monthly expected targets, leaving the significant pressure to the rest months of 2023.

For now, the overall fundamentals of NIO, XPeng, and Li Auto are not problematic. However, the price war is now ferocious, only to put pressure on their phase recovery. To make it worse, competitors including Tesla decide to play their trump card--lower prices. The price cut for volume reduces the gross margin of NEVs, and the emerging automaker, especially the head NEV companies like NIO, XPeng, and Li Auto, who have to withstand pressure caused by reduced gross margin, ever increasing R&D spending, and a loss of market share in the price war. Competition will be even more intense in 2023.

Translator:Wei Xiong

Reviser:Yan Luo

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission