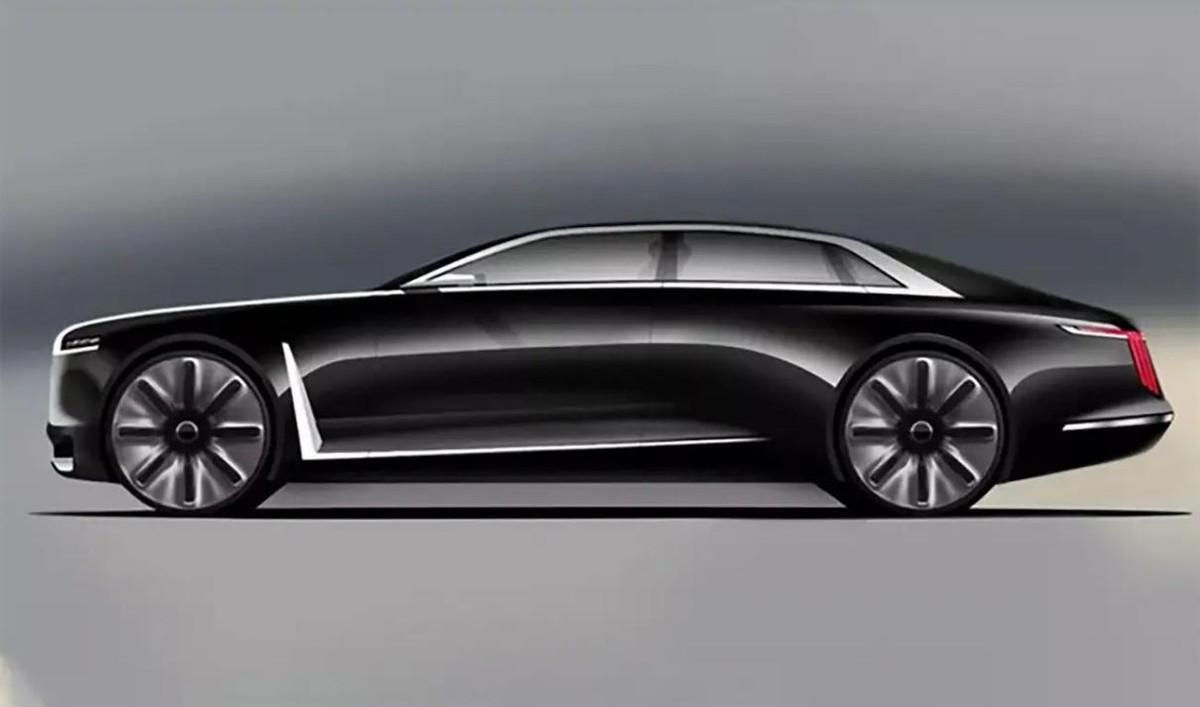

In the highly competitive new energy vehicle market, brands like BYD and Geely have taken the lead with their multiple product lines. Great Wall Motors, known for its focus on SUVs, has also expanded its products by relaunching its Salon brand and merging into WEY this year. The first sedan model under WEY will be showcased as Salon's first product at auto shows later this year.

Sedan can enrich its product

Sedans have always been a major segment in China's passenger vehicle market. By 2023, cumulative retail sales of passenger cars had reached 10.23 million units, accounting for around 50% of the overall passenger vehicle market. Previously, Great Wall Motors primarily focused on SUVs and trucks, however, sedans are always its weakness. In 2014, Great Wall Motors temporarily halted its sedan business.

The Salon brand unveiled its first sedan, positioned as a pure electric sports car with a price tag of 488,000 RMB at the 2021 Guangzhou Auto Show. However, due to technical shortcomings and market conditions, mass production was not scheduled as planned. Instead, after a year of silence, it was announced that Salon would merge into Ora.

Last year, Great Wall Motors sold a total of 1.23 million vehicles, with the Haval brand accounting for 715,200 units and the Great Wall Trucks and Tank brands accounting for 202,300 units and 162,500 units respectively. Together, they represented approximately 87.8% of the total sales volume. Despite achieving impressive results in 2023, Great Wall Motors will face even fiercer competition in 2024 and therefore needs to stabilize its customer base while exploring new avenues for growth.

In 2024, the Great Wall Plan aims to achieve a sales volume of 1.9 million vehicles and a net profit of 7.2 billion RMB. The Haval brand is expected to contribute 50%-60% of the share, while the Wey brand plans to sell between 100,000-200,000 vehicles. Great Wall Motors aims to expand its product line and diversify its brands by integrating Salon into the Wey brand in order to target the mid-to-high-end sedan market.

From a data perspective, addressing the sedan's shortcomings could potentially boost Great Wall Motors' sales to new heights. Clearly, they are unlikely to abandon such a lucrative opportunity.

Whether luxury sedan will succeed?

The Salon brand's first sedan model will be priced at 300,000 RMB, as part of Great Wall Motors' strategic response to intense competition in 2024.

The integration of Salon into the WEY brand is similar to Geely's successful model, which can transform WEY into a multi-line product brand with MPVs, SUVs, and sedans. Additionally, introducing new sedans can enhance WEY's popularity and potentially boost sales. This is something Great Wall Motors urgently needs to consider.

Additionally, with the developments of the new energy vehicle market, consumers' acceptance of high-end sedans and other products is increasing. The sales of BYD and Zeekr’s new energy models serve as strong evidence. From the perspective of future development, Great Wall Motors' limited product range in SUVs and trucks not only hinders its competition against rival brands but also restricts its future growth potential. Therefore, it needs to seek a new breakthrough.

Photo credit:Great Wall Motor

Photo credit:Great Wall Motor

Besides Salon, Great Wall Motors plans a new model in its "ZX" lineup. Limited information is available about this upcoming high-end flagship sedan at present. However, it is certain that Great Wall will re-enter the sedan market after launching its previous models C30 and C50 more than a decade ago. The official response regarding the revival of Salon cars is still pending.

It is widely agreed in the industry that by 2024, there will be increased competition in product categories, positioning, and pricing. Looking ahead to 2030, the popularity of hybrid and new energy vehicles will be driven by lower costs (a 25% reduction in global lithium battery costs) and advancements in next-generation battery technology (such as solid-state batteries). Additionally, advanced intelligent features and configurations are expected to become available in car models priced around 150,000 yuan, down from the current starting price of around 250,000 yuan. As the industry matures rapidly, China's top ten automakers are anticipated to collectively hold over a 90% market share.

Whether Great Wall Motors will enter the top ten list by 2030, the Salon project has given the company an assistant in the sedan market within the 300,000RMB price range, but its impact still needs to be tested by the market.

Translator:Wei Xiong

Reviser:Yan Luo

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission