According to data from the Ministry of Public Security, by the end of 2023, China will have a total of 20.41 million new energy vehicles, accounting for 6.07% of all automobiles. Among them, pure electric vehicles will reach 15.52 million units, representing 76.04% of the new energy vehicle fleet. As per regulations set by the Ministry of Industry and Information Technology since 2016, passenger car manufacturers are required to provide an eight-year or 120,000-kilometer warranty (whichever comes first) for core components like batteries and motors. For those who purchased new energy vehicles in the first year when this policy was implemented, their batteries are already approaching or reaching the end point of their warranty period.

Recently, the CIRI Auto Technology Institute released No.17 research results on the battery-to-vehicle ratio index system, showing an upward trend in the average parts-to-whole ratio for 50 new energy sample models, reaching 51.19% which means that replacing a battery pack would cost over half of the vehicle's market price. Additionally, there was a slight increase of 1.28% in the average price per unit of energy for these batteries compared to the previous period, currently at ¥1644.36/kilowatt-hour.

For consumers who purchased new energy vehicles earlier, replacing the car or battery has become another anxiety.

Anxiety transfer

According to the recommended lifespan of power batteries, the "retirement wave" of EV batteries has already begun and is rapidly growing. Data shows that in 2022 alone, China recycled 415,000 tons of discarded lithium-ion batteries, a year-on-year increase of 75.8%. Taking an EV purchased in 2015 as an example, its battery will start deteriorating rapidly within the next 1-2 years after reaching its lifespan. The main issue following battery aging is a decrease in driving range.

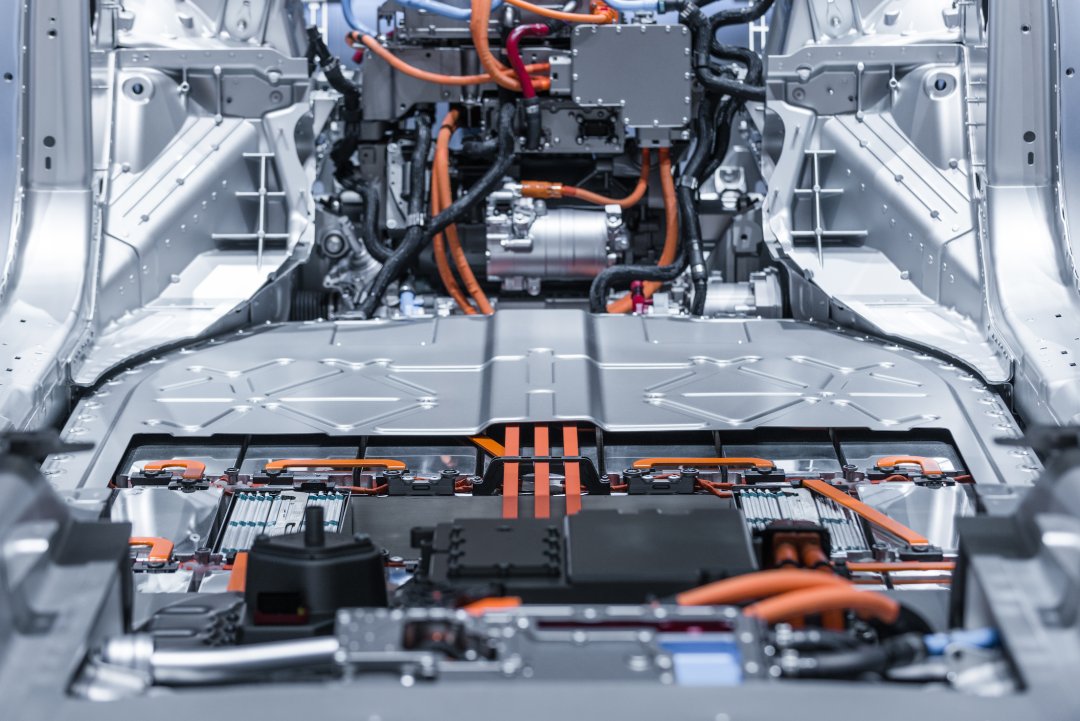

Photo credit:Changan Auto

Photo credit:Changan Auto

The journalist learned from a car owner that the new energy vehicle he purchased in 2015 has experienced a significant decrease in driving range over the past nine years. Initially, it could travel up to 160 kilometers on a full charge, but now it can only go less than 80 kilometers. Currently, I am limited to using it for commuting and need to recharge it daily.

Early new energy vehicles typically used ternary lithium and lithium iron phosphate batteries with an average cycle count of 1000-2000 cycles and a lifespan ranging from 5 to 8 years. By the end of 2022, approximately 510,000 new energy vehicles from the initial group of owners have been decommissioned, consistent with their expected battery lifespan.

However, technological advancements have led to significant improvements in power battery materials and structure. In recent years, the average lifespan of power batteries has surpassed expectations of 6-8 years, with companies like CATL and BYD introducing new batteries that can last over 10 years.

The founder of NIO, Li Bin, warned that without proper technological preparation, power batteries could become a significant burden for users in the future.

The terminal market has already reflected this judgment. Influenced by factors such as lower prices of new cars and the decline in functionality of core components like power batteries, some used car dealers in Beijing are no longer accepting new energy vehicles. Dealers who have already sold their inventory commonly express that "the current resale value of new energy vehicles on the market is not very high."

According to the latest data in February, second hand electric vehicles (3 years old) have a resale value of 54.8%, while plug-in hybrid electric vehicles (3 years old) have a resale value of 55.3%. However, other studies suggest that traditional vehicles (3 years old) within the industry have an average resale value of at least 60% or higher.

Will cheaper batter solve the pain spot?

The main contradiction of 'out-of-warranty' for power batteries lies in the issue of price. According to data from China Automotive Technology and Research Center, regardless of battery type (three-element lithium or lithium iron phosphate), replacing the battery costs at least half or more of the purchase price.

Furthermore, research indicates that three primary factors currently impede consumers from purchasing new energy vehicles: high future battery replacement costs, insufficient driving range, and safety performance concerns.

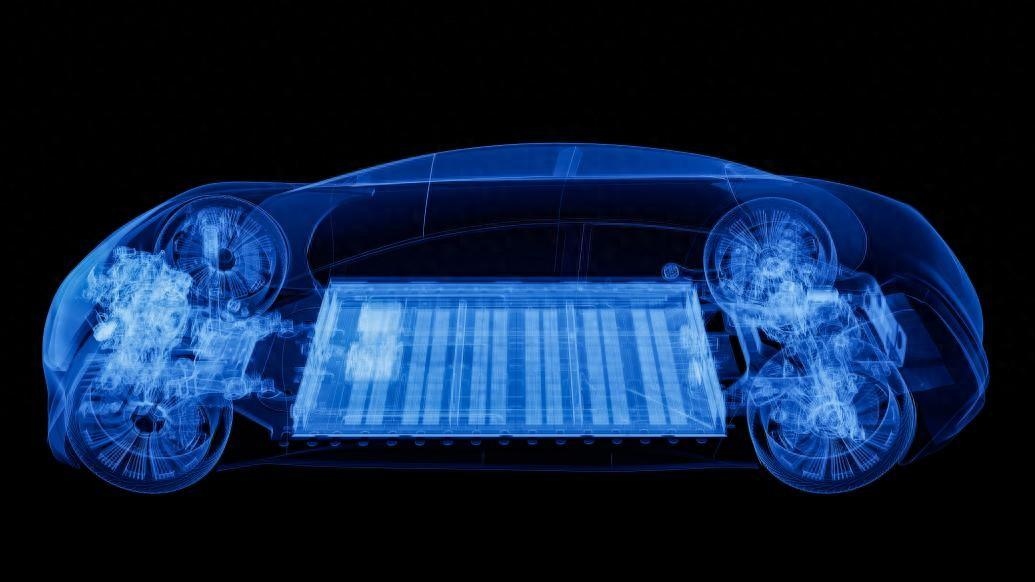

Photo credit:Network

Photo credit:Network

Reducing battery costs is currently crucial for increasing market share and competitiveness in the new energy vehicle industry. To solidify its market position, CATL is actively working on lowering battery costs. Earlier this year, CATL announced plans to launch a 173Ah VDA-standard lithium iron phosphate cell by mid-year, which will be included as standard equipment in several automakers' electric vehicles. The price of this cell will not exceed 0.4 yuan per watt-hour, representing a significant decrease compared to last year's square-shaped lithium iron phosphate cells that cost around 0.8-0.9 yuan/Wh.

When the power battery's energy drops below 70%, it becomes challenging to meet travel needs. Moreover, with the intensifying price war in the new energy vehicle market, some industry analysts are optimistic about consumer groups considering vehicle replacement. On a technological level, lithium batteries have already reached their physical energy density limit, requiring more focus on manufacturing costs and safety issues. Additionally, the recent application of solid-state battery technology brings good news for consumers due to its advantages in battery lifespan.

Translator:Wei Xiong

Reviser:Yan Luo

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission