NETA is finally ready for IPO.

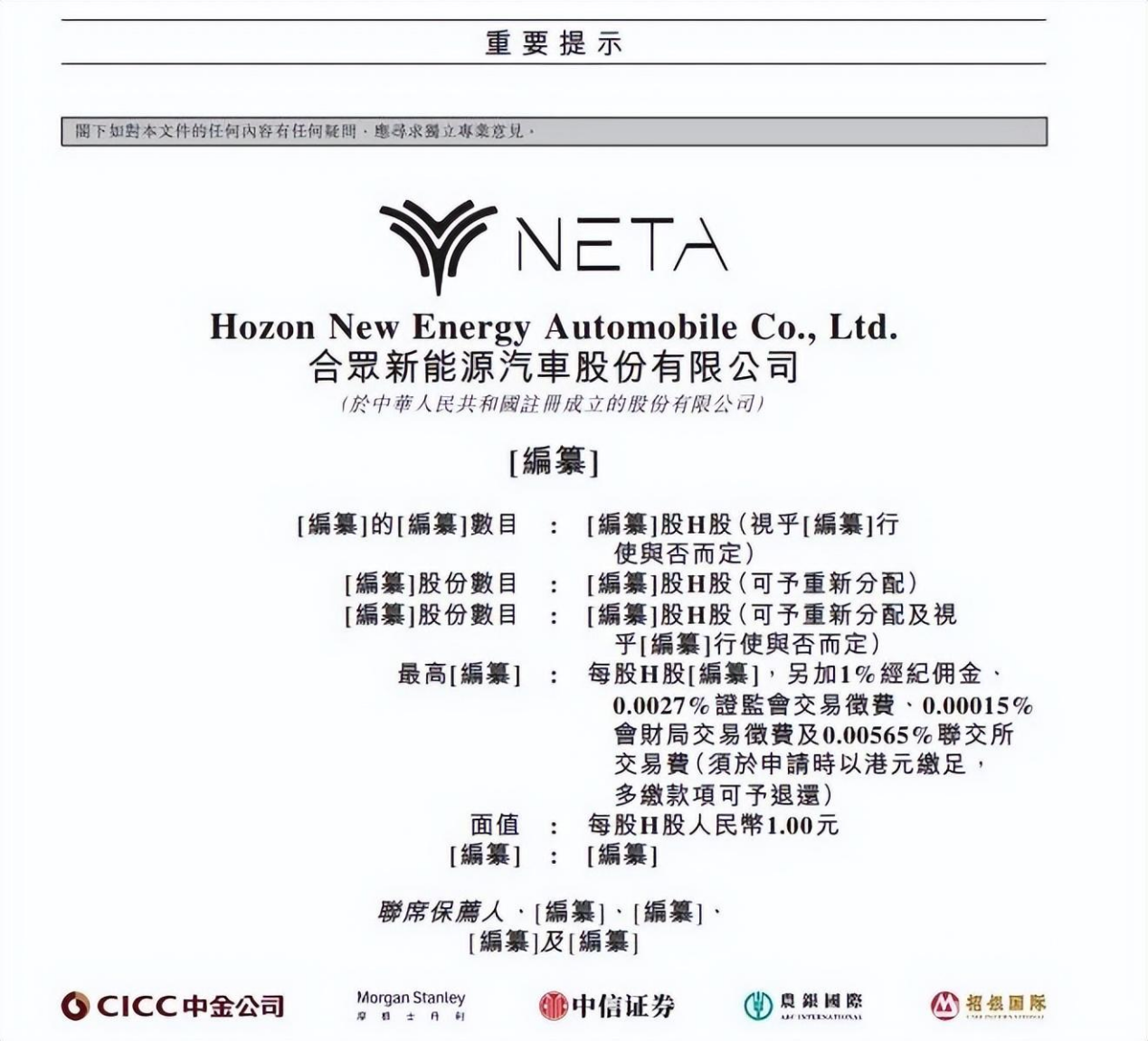

According to a filing submitted on June 26th, Hezhong New Energy Automobile Co., Ltd., the parent company of NETA has officially applied for an IPO on the HKEX. If successful, this will mark a new phase for NETA as it becomes the fifth Chinese new energy vehicle company listed in Hong Kong, following NIO, Li Auto, Xpeng, and Leapmotor.

NETA has adequately prepared for its IPO, having raised 5 billion yuan from multiple institutions two months ago. Additionally, Zhou Hongyi, founder of 360 Group and a major shareholder in NETA, has actively promoted the company this year to generate traffic.

The prospectus of Hezhong New Energy states that the company has a cash balance of 2.84 billion yuan and suffered a loss of 6.867 billion yuan in fiscal year 2023. Given the current situation, it seems that the available funds are insufficient to cover future losses for the next six months.

Seeking an IPO is crucial for NETA Motors' growth and expansion, but resolving urgent needs takes priority at this moment. Can NETA Motors gain investor favor in the fiercely competitive market?

IPO or OUT?

NETA Motors has gained significant attention and boosted brand recognition this year through frequent interactions among its investors, Zhou Hongyi and Zhang Yong.

Zhang Yong, CEO of NETA Motors, stated on social media that since the release of NETA L, lead volume, attention, and order quantity have reached their highest levels since late 2022. This achievement has renewed market attention towards NETA Motors and is seen as a boost for its IPO momentum.

NETA Automobile's previous attempts to go public through an IPO have been unsuccessful. In July 2020, the company announced its plan to list on the Science and Technology Innovation Board in 2021 but failed to achieve this goal due to various reasons. In February 2022, rumors circulated about a potential IPO in Hong Kong, which the company promptly denied.

Photo credit:NETA

Photo credit:NETA

Since its establishment in 2014, NETA has raised a total of RMB 22.84 billion through ten rounds of financing. However, the company has incurred net losses of RMB 4.84 billion, RMB 6.666 billion, and RMB 6.87 billion from 2021 to 2023 respectively, totaling over RMB 18 billion according to the prospectus. As of December 31st, 2023, NETA's cash and cash equivalents amounted to only RMB 2.84 billion, which is sufficient to sustain operations for just over five months at the current rate of loss in that year.

NETA Motors received a total investment of no less than 5 billion yuan from three companies in April this year, to support NETA.

Photo credit:NETA

Photo credit:NETA

The sales performance of NETA Automobile in the terminal market has not been trending upward. In 2021, they delivered 64,230 vehicles, followed by 152,073 vehicles in 2022 and 124,189 vehicles in 2023. Despite briefly leading among new industry players in 2022, NETA Automobile experienced a decline in sales starting from 2023. Looking ahead to 2024 and beyond, the outlook remains bleak as evidenced by May's delivery of only 10,113 units with a year-on-year decrease of 22.4%. From January to May this year, their total deliveries amounted to 43,564 units which accounted for just 14.5% of their annual sales target of 300 thousand vehicles.

NETA Motors' early focus on B2B and B2G, along with government procurement and bulk purchases by corporate entities, as well as deployment in ride-sharing companies, contributed significantly to their initial sales. However, they later shifted their strategy towards the C-end market by selling vehicles through dealerships and direct stores, which accounted for over 80% of their revenue in 2023.

Market analysts believe that NETA Motors' capital operation this time is mainly for financing. If the IPO succeeds, sufficient funds can help NETA Motors expand rapidly and enhance its response flexibility.

Will the overseas market be the last straw?

According to the prospectus, NETA Motors stated that the funds raised from this listing on the Hong Kong Stock Exchange will primarily be used for strategic expansion in overseas markets, enhancing global influence and enriching product portfolio. They will also be allocated towards improving smart car software and hardware technology, expanding sales, service, and charging infrastructure networks in China, as well as funding digital marketing and operational user communities.

In its prospectus, NETA Motors highlights the overseas new energy vehicle market's significant growth potential, projecting a rise from 5.2 million vehicles in 2023 to 13.6 million vehicles in 2028 at a compound annual growth rate of 21.4%. Regarding overseas business, it exported 17,019 vehicles in 2023, accounting for 13.7% of total sales volume and contributing to 12.0% of sales revenue that year.

According to the data, NETA ranked first in export volume among new energy vehicle companies, exporting 16,458 vehicles from January to May 2024. Additionally, based on insurance coverage in 2023, NETA Motors has become one of the top three brands with insured cars in the Southeast Asian market.

Photo credit:NETA

Photo credit:NETA

NETA has expanded into the more profitable mid-to-high-end market and plans to deepen its presence in China's overseas markets, focusing on developing Latin America, the Middle East, Africa, and eventually expanding into Europe. Substantial funding support is also required for the company's expansion into overseas markets.

Will overseas expansion efforts bring significant growth? The main issue for NETA currently lies in its products, as a lack of strong differentiation becomes its 'fatal flaw'. In this era of homogeneity, NETA lacks a prominent moat and is susceptible to competition from new energy vehicle models by traditional automakers.

The person also mentioned that NETA is facing a double-edged sword with its current 'flow competition' effect, while some actions by Zhang Yong and Zhou Hongyi were seen as playing to the gallery. It remains uncertain how much influence they will maintain in the future.

However, NETA is not only selling cars overseas but also establishing local factories, indicating a long-term development strategy in the auto market. Expanding globally may provide an alternative path to new forces due to intense domestic competition.

IPO is not the last step. In the new energy vehicle market, besides BYD and Li Auto's continuous profitability, most of the other brands are still in a state of loss. Moreover, the current capital market lacks enthusiasm for new car manufacturing. Looking at new forces’ experience and current stock price, it becomes evident that IPO does not guarantee success; numerous challenges still exist in the future.

Translator:Wei Xiong

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission