According to the announcement from Honda China, the annual production capacity of its joint ventures in China, Dongfeng Honda and GAC Honda, will be reduced by approximately 20% from 1.49 million vehicles to 1.2 million vehicles. Nissan announced last month the closure of its Dongfeng Nissan Changzhou plant with an annual production capacity of about 130,000 vehicles, resulting in an overall output reduction of 1.47 million vehicles.

The main reason for these two Japanese giants to make such a decision is sales. In June, Honda's terminal sales in China were 68,966 vehicles, a decrease of 39% compared to the previous year. From January to June, Honda's sales in the Chinese market totaled 415,906 vehicles, reflecting a decrease of 21.5% compared to the previous year.

In response to current market challenges, Honda has taken measures such as increasing investment in new energy vehicle research and development and clarifying its electrification strategy. In May of this year, Honda announced various initiatives in automotive electrification, including advancing goals, reforming procurement and production structures, implementing an electrified product line strategy, and financial strategies.

Nissan's performance in the Chinese market remains sluggish, with a 5.4% decrease in vehicle sales during the first half of the year compared to the same period last year.

The decrease in production capacity further confirms the declining market share of Japanese automakers in China. According to statistics from the China Association of Automobile Manufacturers, Japanese brands accounted for only 14.9% of the market share in the first half of this year, marking their lowest level since 2015.

Apart from Japanese car companies, other joint venture car companies also face the issue of underutilized production capacity. In the past two years, several struggling joint venture car companies have consistently encountered challenges in "shutting down and transforming" their unproductive production facilities. With increasing market competition, idle production capacity in Chinese joint venture car companies has prompted them to actively seek more development opportunities.

The rate of capacity utilization is serious inadequate

There have been numerous factory closures and transfers among joint venture car companies in the past two years due to intensified competition in the domestic market. Some joint venture car companies have experienced continuous sales declines, resulting in idle factory capacity. Factory closures and transfers are now common practices for adjusting production capacity.

Previously, Beijing Hyundai had five production bases in China, but it has already sold its first factory in the Shunyi District of Beijing and the Chongqing factory, while the second factory in Beijing has long been idle."

In 2022, Dongfeng Honda acquired the second factory of DPCA. The following year, Dongfeng Group expanded its acquisition by purchasing the corporation's third factory. Additionally, in the same year, GAC Mitsubishi sold its Changsha plant to GAC Aion. Joint venture automakers often contemplate the "closure and transformation" of their factories due to decreasing sales and underutilized production capacity or even prolonged shutdowns.

Apart from Japanese car companies, Volkswagen faces a significant production capacity issue due to its previous dominance in the Chinese car market. Public data shows that Volkswagen Group's three joint ventures in China have a combined production capacity of over 5.4 million vehicles. However, their projected sales volume for the Chinese market by 2023 is only 3.236 million vehicles. During the first half of this year alone, they sold 1.26 million vehicles, highlighting a production capacity gap estimated at around one million vehicles.

Despite being an established joint venture car company, SAIC General Motors struggles with low-capacity utilization. Public data reveals that out of its total factory capacity of 2.6 million vehicles, it only managed to sell 1 million last year - far below the critical threshold of a 50% utilization rate. Sales in the first half of this year amounted to just 255,000 vehicles.

The overall capacity utilization rate of joint venture car companies this year is reported to be below 50%, significantly lower than the industry average. Additionally, luxury brand factories have also experienced a decline in their capacity utilization rate. Considering the trend in the Chinese market, domestic brands have taken over these lost shares.

Domestic brand start to expand

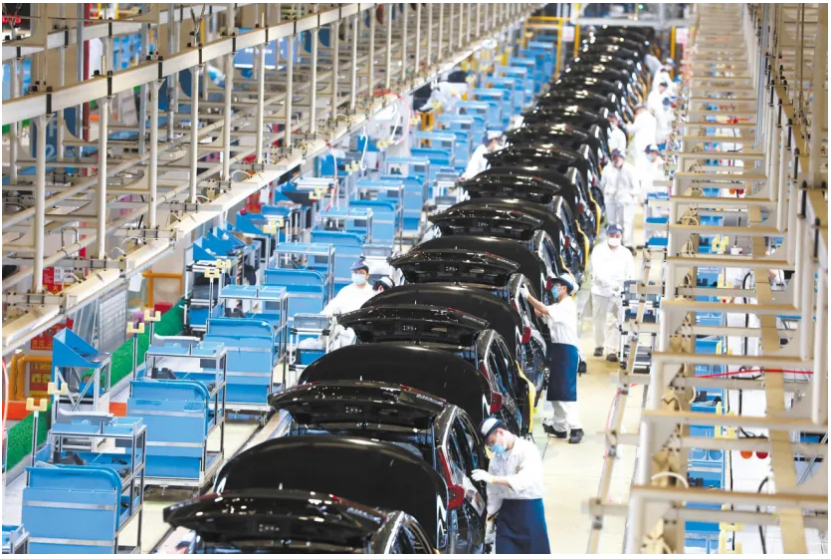

The fact is that there is excess capacity in joint venture car companies, and as a result, Chinese automobile enterprises are rapidly expanding, following the path of previous joint venture brands' land grabbing in China. This creates a sharp contrast to the performance of joint ventures: while one side is closing factories, the other side continues to expand production.

Previously, NIO was approved to construct its third factory because the existing two factories had reached their single-shift production capacity and were unable to meet market demand with new product launches. Additionally, Beijing Hyundai's second factory has been resold to Li Auto for producing MEGA electric vehicle models. Furthermore, Voyah is utilizing a leasing model at Dongfeng Nissan's Yunfeng factory in Wuhan for manufacturing Voyah Zhiyin models.

In the short term, China maintains an average new energy vehicle production capacity utilization rate of about 80%, with certain major groups surpassing full capacity. For instance, BYD had projected a passenger car production capacity of 1.9 million vehicles for 2023; however, it achieved an actual output of 3.03 million cars - resulting in an exceptional utilization rate of approximately 159.5%. After witnessing substantial sales growth in 2021, BYD expanded its production capacity and increased its already rising utilization rate.

One of the reasons for the occupation of the joint venture market is that joint venture brands have lagged behind independent brands in transitioning to new energy and intelligent tracks. Independent brands like BYD have launched multiple plug-in hybrid and pure electric models at lower prices and operating costs, thus capturing the ecological niche of joint venture brands.

In the first half of this year, domestic brands' market share rose to 56.5%. With independent brands like BYD and Geely showing growth momentum, it's expected that domestic brands will further increase their market share in H2. Joint venture brands' decrease in production and clearance activities can help fulfill the capacity expansion needs of domestic brands, especially for internal capacity digestion within automotive conglomerates, promoting their transformation and development.

However, while some joint venture brands are closing traditional fuel vehicle factories, they are actively establishing new energy vehicle factories. Honda will start production in two new energy vehicle factories in September and November. According to Japanese media reports, Nissan plans to launch pure electric SUV models like the "Ariya" in China and aims to increase sales by 200,000 vehicles by March 2027. The recovery of joint venture brands' performance from the era of traditional fuel vehicles still requires time for verification.

Translator:Wei Xiong

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission