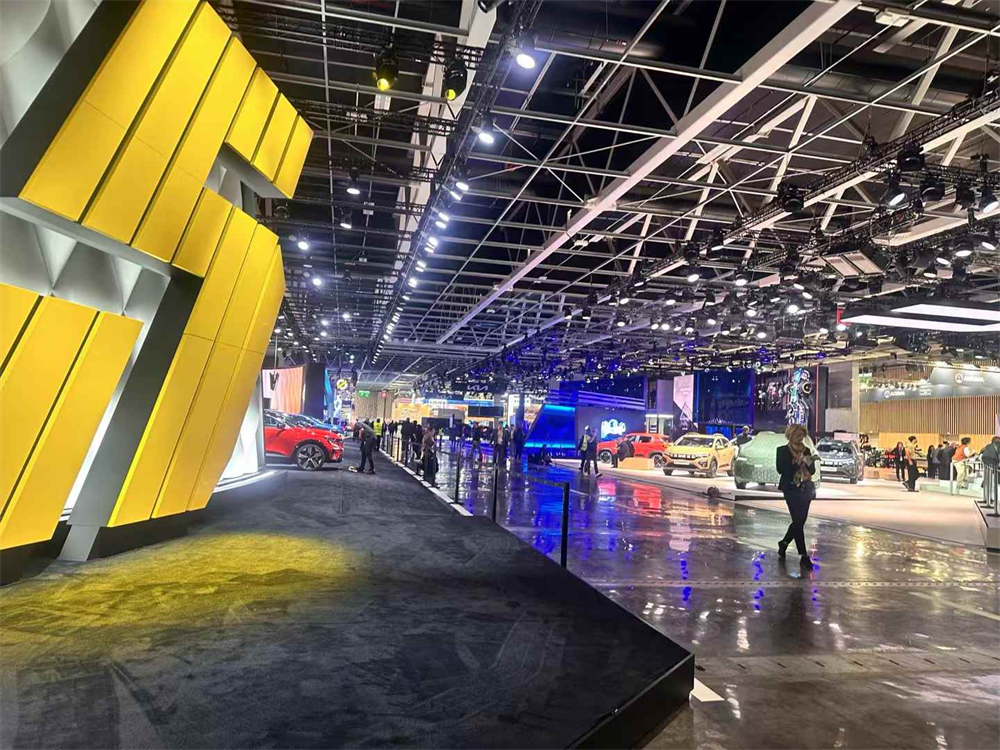

The 90th Paris Motor Show, one of the world's top five auto shows, concluded on October 20th. This year, Chinese car brands' exhibition booths gained popularity due to the impending tariff increase on Chinese electric vehicles by the European Union.

The Paris Motor Show this year features 48 global automotive brands, with approximately one-fifth of the exhibitors being Chinese car companies like FAW Hongqi, BYD, Xpeng, Leapmotor, and GAC. These Chinese brands have eagerly showcased their new products and technologies at the exhibition to demonstrate their ambitions in cultivating the European market.

Higher tariff cannot prevent Chinese car companies’ passion

Unlike multinational car companies that have already achieved a high level of globalization, Chinese car companies are currently in the stage of vigorous expansion and seeking a global presence. Major international auto shows serve as their prime platform for showcasing. According to statistics, Chinese car manufacturers such as FAW Hongqi, BYD, AITO, FORTHING, Skyworth Auto, GAC Motor, Xpeng, Leapmotor, and SAIC Maxus appeared at this year's Paris Motor Show to demonstrate numerous new energy vehicle products and their determination to expand globally.

Despite the imminent threat of high anti-subsidy tariffs from the European Union, Chinese car companies remain committed to the European market, as evident by their strong presence at this year's Paris Motor Show. BYD, a leader in China's electric vehicle market, showcased its Sea Lion 07 at the show to compete with Tesla's Model Y and has already launched it in China. The company aims to enter the European market by 2025 and make its debut in Europe through the Paris Motor Show in 2022, introducing eight models within two years.

Despite EU tariffs, Li Ke, Executive Vice President and President of BYD Americas, remains confident in BYD's prospects in the European market and believes they can convince German consumers to choose their cars within six months.

Guangzhou Automobile Group has officially released its "European Market Plan" and will actively explore establishing a technology center in Europe. It plans to introduce its products into multiple European countries by the end of this year, complete a European transit warehouse construction by 2025 for enhanced parts supply efficiency, and gradually establish a service support system covering most European markets by 2028. The first model, Aion V, will be available for European consumers next year.

Leapmotor will introduce the C10 SUV and T03 city electric car to the European market in September this year. They have also unveiled a new model, the Leapmotor B10, at this car show. The company has emphasized that the B platform is crucial for its global strategy, with plans to launch multiple models by 2025. During the event, it marked the first joint appearance on stage of CEO Zhu Jiangming from Leapmotor, CEO Carlos Tavares from Stellantis Group, and International CEO Xin Tianshu.

Tang Weishi, Leapmotor 's CEO, stated that Leapmotor is among China's fastest-growing and most impressive new forces. Local dealers and investors are highly interested in Leapmotor due to the urgent market demand for technologically advanced and reasonably priced electric vehicles. Currently, Leapmotor International has entered 13 European countries with a goal of establishing 500 sales points in Europe by the end of 2025.

Xpeng Motors debuted its flagship model P7+ and initiated pre-sales at the Paris Motor Show, emphasizing its long-term commitment to the European market. They also announced plans to introduce more new models and facelifts, as well as improve their after-sales network and service quality. Notably, French President Macron visited Xpeng's booth at the show and expressed interest in investment from Xpeng Motors in France.

In addition to Chinese automakers, Huawei Cloud's automotive solution, Sunwoda, and other component suppliers also appeared at the Paris Motor Show to expand their overseas supply scope.

Companies are competing with entry level models

European car manufacturers currently face various challenges in transitioning to electrification, including concerns over consumer costs, slowing EV demand in Europe, a delayed rollout of charging stations, and intense external competition.

The average retail price of electric vehicles in Europe is projected to reach 66,000 euros by 2023, while in China it is estimated to be around 32,000 euros during the same period - less than half of Europe's. Affordable models priced at around 20,000 euros are being developed by many European car manufacturers but won't be available until at least 2025.

The sales of pure electric vehicles in the European Union decreased by 43.9% in August this year compared to the same period last year, marking a continuous decline for four months due to their high price, which has discouraged interested European consumers. The EU's decision to impose tariffs on Chinese electric vehicles may worsen this situation.

S&P Global's Chief Automotive Analyst, Tim Echert, finds the European regulatory agencies' requirement for the industry to shift towards pure electric vehicles increasingly problematic due to high acquisition costs and limited home charging infrastructure for many Europeans.

In order to reverse this situation, car manufacturers like Stellantis, Renault, Volkswagen, Hyundai, and Tesla plan to introduce affordable electric vehicle models priced at 25,000 euros in the European market. Renault led the way by unveiling the new R4 at the auto show with an expected price below 35,000 euros, it also introduced the new R5 25,000 euros. They also showcased a prototype of the electric Twingo which is expected to be priced below 20,000 euros upon its market release in 2026.

Citroen, Skoda, and other brands have launched electric cars priced below 35,000 euros at this year's Paris Motor Show. Thierry Koskas, CEO of Citroen, stated that they will introduce an electric car priced below 20,000 euros in the first half of next year to further lower the threshold for electric vehicles. The Bigster SUV will be available in Europe in early 2025 with a starting price below 25,000 euros.

Additionally, the C3 Aircross by Stellantis Group will be produced on their Smart Car platform, offering affordable options in both electric and internal combustion engine versions. The entry-level variant, priced below 20,000 euros, is set to launch in the first half of next year. The B10 developed in collaboration with Leapmotor will also serve as a key product for entering the budget-friendly price range.

From the Paris auto show, it is evident that electric vehicles have become the driving force for growth in the global automotive industry. Multinational car companies are increasingly aware of the development gap between Chinese companies and new energy companies and are accelerating their entry-level product layout to reverse this situation. They have showcased various new energy vehicle models and cutting-edge technologies, aiming to take advantage of tariff protection policies and catch up with Chinese car companies' pace in electrification transformation. According to Germany's Commercial Newspaper, despite facing EU tariffs on Chinese automakers, Chinese automobile brands remain determined to expand into European markets.

Translator:Wei Xiong

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission