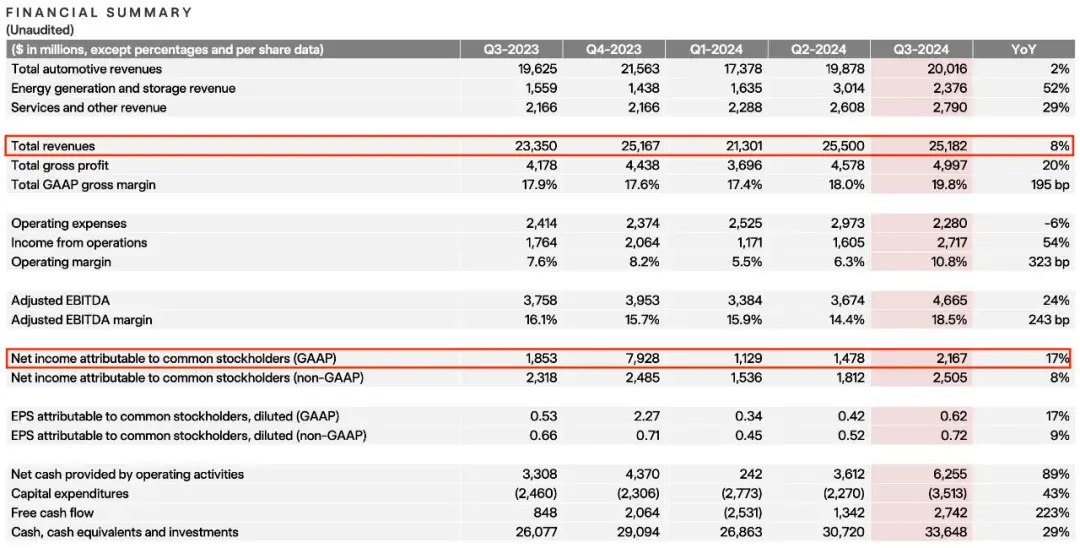

Recently, Tesla released its Q3 2024 financial report, revealing a rebound in profitability with $25.182 billion in revenue, an 8% YoY increase. The Chinese market played a significant role in this growth, as Tesla sold 249,135 electric vehicles produced locally, marking a 21.09% increase from the previous quarter.

Tesla attributed the increase in net profit to a record low cost of goods sold per vehicle at around $35,100. Additionally, Tesla's gross margin for Q3 rose by approximately 2 percentage points to 19.8%. The operating profit margin for the same period stood at 10.8%, and free cash flow totaled $2.7 billion.

The response to Tesla's Robotaxi has been poor on Wall Street, causing a temporary drop in its stock price. However, after the release of Tesla's third-quarter report, analysts believe that the worst period for the company is over and market confidence has increased. As a result, Tesla's stock price surged by 13.48%.

The financial report for Q3 is unexpected

The revenue for Q3, according to Tesla's third-quarter report, was $25.2 billion, which is 8% higher compared to the same period last year. However, it was a bit lower than the previous quarter's $25.5 billion with a tiny decrease of 1.2%. The GAAP net profit for Q3 showed a big increase of 46.6% compared to the previous quarter, reaching $2.167 billion and showing a YoY growth of 17%. The non-GAAP net profit for the quarter was $2.5 billion (RMB 178.1 billion), with an operating profit margin of 10.8%. Cash and investments increased by $2.9 billion (RMB 20.67 billion) in Q3, reaching a total of $33.6 billion (RMB 2394.3 billion). The cost of goods sold per vehicle reached its lowest-ever level at around $35,100 (approximately RMB 250,000).

In terms of production, Tesla manufactured a total of 469,796 vehicles in Q3, with Model 3 and Model Y accounting for 443,668 units, marking a 6% YoY increase. Other models saw production volumes reach 26,128 units, showing a significant growth rate of 91% compared to the same period last year. Regarding deliveries, Tesla delivered a total of 462,890 vehicles in the quarter. Among them, Model 3 and Model Y accounted for 439,975 units with a YoY growth rate of 5%. The delivery volume of other models stood at 22,915 units with a growth rate of 43%.

(Tesla)

(Tesla)

The thing is, Tesla crushed it in China last month by selling over 72,000 electric vehicles. That's a whopping 66% increase compared to the same time last year and their highest sales volume of the year so far. And get this, their electric vehicle sales in the Chinese market went up by 12% from July to September.

Amidst the global contraction of the electric vehicle market this year, Tesla's sales and financial results have raised investor concerns, leading to a 14% annual decline in its stock price. Before releasing its third-quarter report, analysts had already highlighted Tesla's high uncertainty and potential need for further price reductions due to the entry of low-cost electric vehicles into the market, which could impact profits.

(699pic.com)

(699pic.com)

However, despite the continuous decline in car prices, Tesla has significantly improved its automotive gross margin by implementing cost reduction and efficiency enhancement measures. These include optimizing the supply chain, reducing raw material costs, and improving production efficiency. These measures have helped Tesla maintain a relatively high gross margin despite the decrease in unit price. According to financial reports, excluding carbon credits impact, Tesla's automotive gross margin reached 17.1% in Q3, representing a 2.4 percentage point increase compared to the previous quarter.

Tesla achieved an operating profit of $2.7 billion in Q3, surpassing Wall Street's expectation significantly, thanks to strict expense control and improved gross profit margin per vehicle. Despite falling short of analysts' revenue expectations, Tesla unexpectedly rebounded in profitability during the third quarter.

The plan will encourage people

It is worth noting that some investors and analysts are not entirely satisfied with the revenue growth rate, as they believe it falls short of market expectations despite the increase in numbers. They emphasize Tesla's need for more proactive product launches and stronger marketing efforts to maintain its market share against growing competition from rivals.

Musk also revealed Tesla's future growth plans, including the production of new affordable car models starting in H1 2025. Market analysts expect these models to be priced significantly lower than the existing Model 3 and Model Y, facilitating further global market expansion for Tesla.

(699pic.com)

(699pic.com)

Tesla expects its car sales to grow by 20%-30% and reach approximately 360,000-550,000 units by 2025 with the launch of new models. For reference, in 2023 alone, Tesla delivered around 1.81 million vehicles. This expectation instills great confidence in Tesla's investors.

Elon Musk has announced that mass production of the autonomous taxi Cybercab is set to begin in 2026, with a minimum annual target of 2 million vehicles. Additionally, the self-driving taxis will be manufactured in multiple Tesla factories. According to Musk, producing low-cost cars requires an immense amount of work, and achieving a 20% profit from car costs is even more challenging than designing the car and building an entire factory from scratch.

(Tesla)

(Tesla)

It is worth mentioning that Tesla achieved a global production milestone of 7 million vehicles the day before releasing its third-quarter report. In the same month, Tesla's Shanghai super factory reached a production milestone of 3 million cars. Additionally, Tesla is actively expanding its energy storage business as a new growth point and has seen an explosive performance with revenue from this sector increasing by 52%. The Shanghai Gigafactory for Energy Storage, Tesla's first facility built outside the United States, is expected to begin production in Q1 2025 to supply both Chinese and global markets.

For Tesla, which hasn't launched a new vehicle in a while and still faces limited production capacity for the Cybertruck, cost improvement in Q3 is crucial to boost performance, especially considering the absence of successful models that can compete with Model Y and Model 3. According to Musk, people only refrain from buying Tesla due to its lack of affordability. A significant portion of consumers prioritize reliability and price when purchasing cars as vehicles from point A to B. This belief also establishes a strong foundation for Tesla's future development.

Translator:Wei Xiong

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission