Amidst profound adjustments in the global economic landscape and surging waves of technological revolution, the automotive industry, a vital pillar of the national economy and a key frontier for technological innovation, is undergoing unprecedented and profound transformation.

Held from July 10th to 12th in Shanghai's Jiading District under the theme "Enhancing Quality for Innovation, Winning the Future with Intelligence," the China Auto Forum convened government, industry, academia, research, and business leaders. Against the backdrop of NEV penetration exceeding 50% and China securing its position as the world's top auto exporter for two consecutive years, the forum facilitated in-depth discussions on core themes including "Managing Excessive Competition," "The Intelligent Leap," and "Global Breakthrough."

From electrification to intelligence

China's auto industry has established global leadership in electrification. In 2024, domestic NEV sales reached 12.866 million units, achieving a 40.9% penetration rate. In H1 2025, domestic vehicle production and sales both surpassed 15 million units for the first time, increasing by 12.5% and 11.4% year-on-year respectively. Government trade-in policies proved effective, leading to significant improvement in domestic demand. NEV growth remained robust: January-June production and sales totaled 6.968 million and 6.937 million units, up 41.4% and 40.3% year-on-year. NEV sales accounted for 44.3% of total new vehicle sales.

At the forum, Fu Bingfeng, Executive Vice President and Secretary General of the China Association of Automobile Manufacturers (CAAM), revealed that NEVs now constitute 10% of China's total vehicle parc. For the full year, NEV sales are projected to reach 16 million units, potentially exceeding 50% of new vehicle sales.

The explosive growth of the NEV market stems from continuous technological advancements that significantly enhance product performance and quality. Simultaneously, the gradual improvement of charging infrastructure has alleviated consumer concerns. On the demand side, the recovery of household consumption capacity and willingness has unleashed pent-up demand for both essential vehicle purchases and upgrades.

These achievements also benefit from policy support and industrial chain synergy. For example, BYD's megawatt-level flash-charging technology elevates replenishment efficiency to "400 km range with a 5-minute charge." Companies like Zeekr and Huawei are simultaneously deploying ultra-fast charging technologies, driving charging infrastructure towards a "gas station-level" scale.

However, competition in electrification is shifting from singular range metrics towards "integrated technological" innovation. CATL's Shenxing Dual-Core Battery, utilizing cross-chemical system combinations (e.g., Sodium-Iron, Iron-Iron), balances high capacity with low energy consumption, offering novel approaches to address pain points like low-temperature performance degradation and cost control.

Intelligence has become the "new track" for industrial competition. In 2025, Level 3 autonomous driving enters mass production, with technologies like Huawei's ADS 4.0 and XPeng's VLA+VLM models achieving breakthroughs in computing power and scenario adaptability. The penetration rate of Level 2 and above ADAS is projected to reach 65%.

The deep application of AI is further reshaping the industrial ecosystem: Autohome utilizes its "Cangjie Large Model" to create a full-chain AI marketing solution covering the entire customer lifecycle from demand insight to after-sales service. The jointly developed "Chasing Light Panorama" AR-HUD by XPeng and Huawei integrates dynamic light carpets and complex road condition annotations into the interactive experience, redefining the value proposition of intelligent cockpits.

At the forum, Wan Gang, Chairman of the China Association for Science and Technology, emphasized the need to advance the construction of "Hydrogen Highways" and "Hydrogen Corridors" to improve application scenarios for fuel cell vehicles. Meanwhile, Chen Liming, President of Horizon Robotics, noted that widespread adoption of intelligent driving requires overcoming the synergistic bottlenecks of algorithms, computing power, and engineering capabilities.

Internal Competition or Globalization

Despite continuous market expansion, the industry's "excessively competitive" landscape has become a significant concern. "The automotive industry's profit margin has been declining for nearly eight years," stated Fu Bingfeng at the forum, underscoring the severe profitability challenge currently facing the sector.

The auto industry's profit margin declined for the eighth consecutive year in 2024, with the "increased volume without increased profit" trend persisting into H1 2025. Contributing factors include the rapid expansion of the NEV market attracting massive capital influx and intensifying competition, fueling relentless price wars. Concurrently, the industry's critical transition towards electrification and intelligence demands enormous R&D investment, significantly escalating cost pressures.

Price wars have compressed profit margins, trapping some automakers in a vicious cycle of "trading price for volume." Fu Bingfeng pointed out the necessity of establishing industry self-regulation mechanisms to curb practices like payment defaults and technology plagiarism, thereby steering the market towards value-driven competition. This view resonated widely at the forum: GAC Group Chairman Feng Xingya reflected on the missed opportunity with range-extender technology, stressing that "quality and innovation rank higher than sales volume." Chery Chairman Yin Tongyue called for an "industry united front," promoting self-discipline and cooperation over chaotic competition. Chen Zhuo, President of AVATR Technology, observed, "While numerous factors compel automakers to accelerate and adapt to competition, various signs simultaneously suggest a need to return to long-termism and uphold fundamental principles."

To navigate this challenging environment, companies must drive transformation across multiple dimensions, shifting from a price-driven to a value-driven approach. Technological innovation is paramount, requiring increased R&D investment in cutting-edge fields like new energy and intelligent connectivity to achieve breakthroughs in core technologies and enhance product value. For instance, Huawei, leveraging its deep expertise in communications and AI, provides advanced intelligent driving solutions that empower automakers to boost competitiveness. Feng Xingya's perspective underscores that companies need both steadfast principles and a comprehensive enhancement in understanding customer needs, restructuring user operations, and embracing core user demands. "Products neglecting emotional appeal struggle to stand out," he noted, highlighting this as a critical element in Chinese auto brand building.

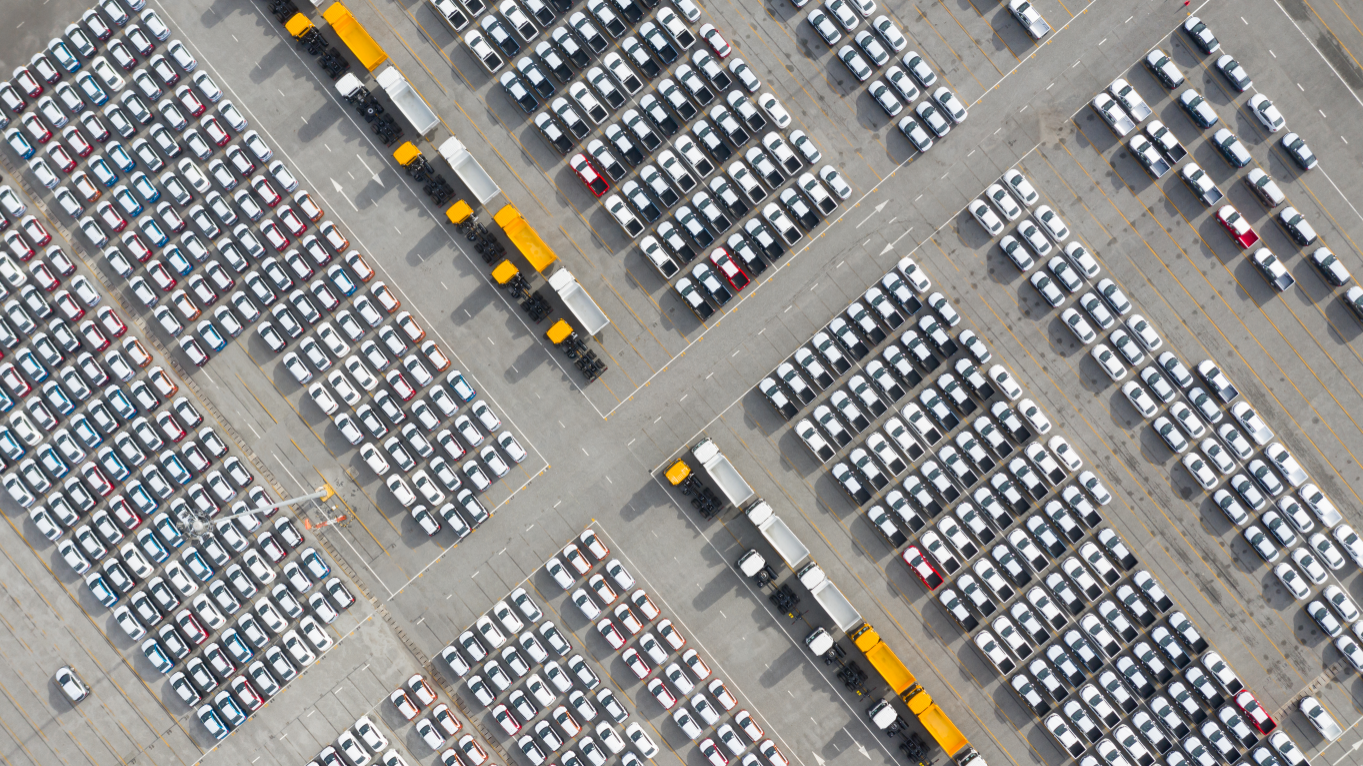

Global expansion represents another key strategy to counter domestic over-competition. In 2024, China exported 5.859 million vehicles, marking a 19.3% year-on-year increase and securing its position as the world's top exporter for the second consecutive year. However, challenges such as the EU's countervailing duties and geopolitical barriers are increasing the complexity of overseas ventures. Jochen Goller, President & CEO of BMW Group Region China, explicitly opposed unilateral protectionism, advocating for a new industrial model prioritizing both "efficiency and security" through free trade and resilient supply chains.

Martin Sander, Secretary General of the European Automobile Manufacturers' Association (ACEA), emphasized the need for China and Europe to deepen cooperation on technical regulations and data interoperability to provide institutional safeguards for automakers' globalization. Concurrently, Chinese automakers are exploring a new pathway of "localized production + technology export": Companies like Chery and BYD are establishing factories in regions such as Southeast Asia and the Middle East, leveraging local supply chains to reduce production costs. Initiatives like the overseas launch of Autohome and its "Space Station" plan are empowering brand internationalization through digital platforms.

The 2025 China Auto Forum reveals the complex landscape of the industry's transformation: On one hand, continuous breakthroughs in electrification and intelligent technologies are driving the Chinese automotive sector from "scale leadership" towards "quality leadership." On the other hand, the need to curb excessive domestic competition and navigate intensified global competition is compelling the industry to redefine its competitive logic. While achieving remarkable successes, China's auto industry faces significant challenges. However, challenges coexist with opportunities. With relentless technological innovation, sustained market expansion, and the progressive refinement of corporate strategies, the Chinese auto industry is poised to emerge as a frontrunner in global competition.

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission