We can find in the 2021 China Passenger Car Tire Customer Satisfaction Research Report (PCTCSR) published by Car Research that:

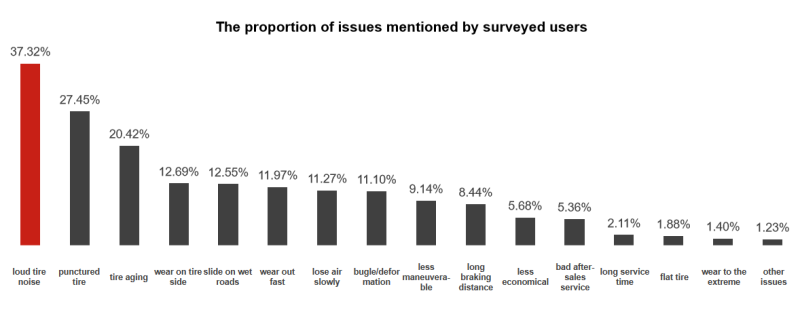

1. Customers provided intensive feedback on the issue of “loud tire noise”

2. Customers lack initiative of acquiring knowledge about tire and its maintenance.

3. For the aftermarket installed products, consumers prefer to pay for service convenience and tire quietness.

4. The positive images of tire brands are making a more profound impact on customers’ purchasing decisions in both factory-installed and aftermarket-installed products.

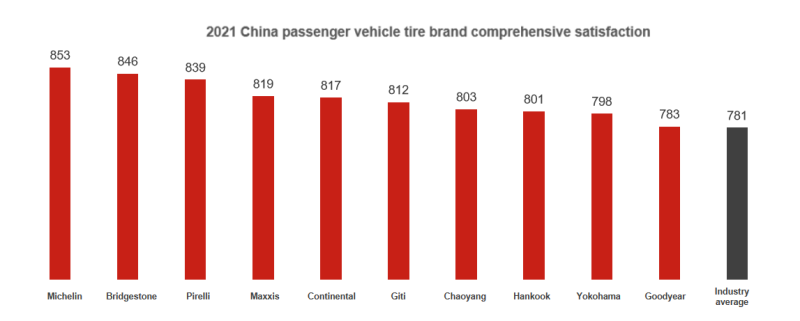

20 main tire brands were selected in the 2021 research, and their comprehensive performance in the retail market, taking into consideration customers’ pre-sale attention and their after-sales satisfaction, are evaluated from dimensions such as brand, product and service, etc. The PCTCSR is a special study carried out by Car Research in the field of auto parts. Since 2017, the study has been conducted every 2 years.

Low user attention

In the three surveys conducted since 2017, car owners have always paid little attention to tires whose attention level ranked sixth among that of eight major systems that make up a whole car. Only when customers have tire replacement plans, do they begin to pay close attention to tire brands, especially its related indicators.

Compared with users passively possessing tire knowledge, users who actively maintain and replace tires have a more accurate understanding of tires. They accumulate professional knowledge mainly through network channels, and in combination with tire wear degree, tire lifespan, the same tire puncture frequency, vehicle mileage and other information, they can make a judgment whether a tire should be maintained and replaced.

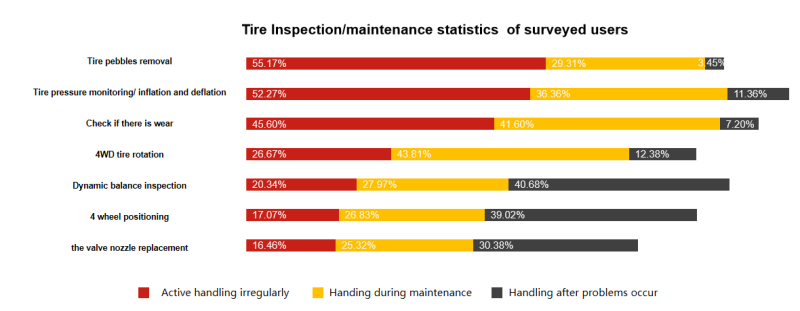

In terms of daily maintenance, these car owners, when inspection and maintenance of tires are needed, mostly focus on tire pebbles removal and tire pressure monitoring. For lack of the test bench and professional equipment, some inspection items such as 4WD tire rotation and dynamic balance are only carried out when problems occur or the whole car needs maintaining.

When there is a punctured tire, 42.19% of the users chose to replace it with a spare tire, and 76.56% for a flat tire, but 57.81% of the users have never checked indicators like the spare tire pressure.

Leverage needs of customers who are “willing to pay for convenience” and achieve high growth in sales

Car maintenance platforms have become customers’ first choice.

In retail stores, car maintenance platforms that integrate online and offline resources have improved customer experience and helped them to make choices with less hesitation when faced with diversified and fragmented services. Compared with the data of 2019, the car maintenance platform has skyrocketed from the last to the first on the ranking of the most preferred way of repairing and maintenance. The price transparency and the convenience of online selection and offline scheduled installation are the keys to improving the consumer experience.

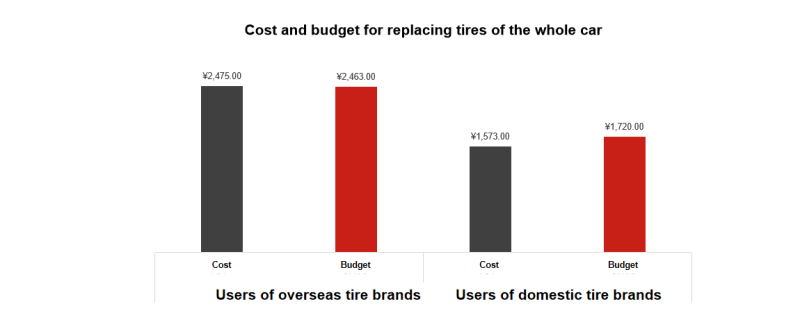

There are four factors affecting customers’ budgets: tire brand, tire size, car price, and how long they expect to continue using the car. Among the four, customer’s overall budget of overseas tire brands is higher than domestic ones, and the other three factors have a “positive correlation” with the budget.

Customer’s awareness of tire surface parameters increased .

When customers buy tires online, they can match the tire specification through car model detailed information, or with reference to the original tire parameters. The former way requires them to accurately offer information such as car brand, series, displacement, model year, and even configuration version, which is more difficult to operate than the latter way. It’s found in the study that the influence of tire with marked parameters on customer purchases increased significantly.

Among the parameters represented by the tire surface identification, customers show the greatest awareness of its date of manufacture, and they mainly focus on the related inventory time.

Six months is the “watershed” time customer regard as a standard to judge whether a tire is an “inventory” product. Only 30% of customers surveyed don’t refuse buying tires that have been in stock for more than half a year.

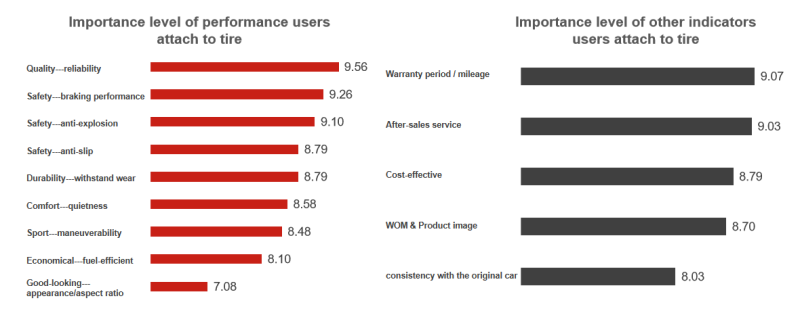

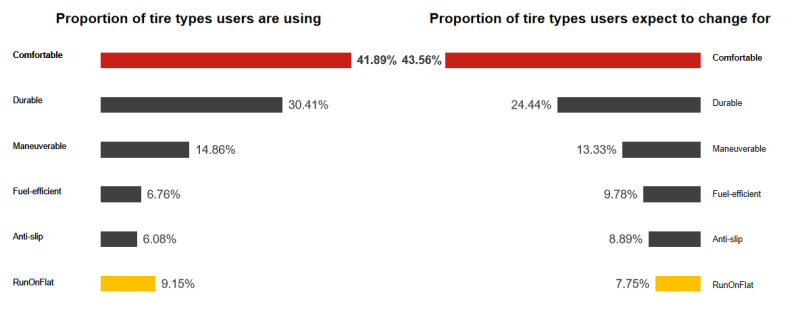

The demand for quietness of the aftermarket installed products is increasing. The quality and safety of tire product characteristics are two dominant factors that determine the customers’ purchasing behavior, and after-sales services, like the warranty period, have also become their basic demands.

Currently, customers’ demand for product performance and service that are mentioned in the chart is widely valued by tire manufacturers, and the fact that poor experience customer gained with tire quietness during use will exert a more profound impact on their future purchase decisions than before. Thus the quietness becomes a key point to which enterprises can make effort in terms of after-sale installed product supply.

Significant increase in customer’s brand awareness of some domestic brands

Faced with a variety of tire brands, customer’s brand awareness is a way to reflect a brand’s advertising effects, attractiveness and its “brand force”. The study analyzes the brand awareness through three dimensions:

1. Top of mind: the first brand that customers think of when referring to tire, which is related to mental occupation;

2. Unaided awareness: Brands that customers can actively think of without being aided or prompted, which constitute a choice pool when customers make purchases;

3. Aided awareness: Brands that customers can recall after being prompted, representing how well they identify these brands.

From the overview of brand awareness, customer’s awareness of Michelin is far ahead in overseas brands in the aspect of psychological occupation rate, with over 70% mental occupation rate; among domestic brands, Chaoyang Tire saw an obvious increase, with all three dimensions ranking the first. It should be noted that awareness types mentioned above are limited to positive awareness, for some of the customers surveyed have negative brand awareness of some certain brands and refused to buy any products of those brands when they need to replace their tire.

In the study of customer satisfaction with tire brands, it’s found that tire brands which have been originally equipped with a car from the factory can affect customers’ purchase decision, for they would put same configuration products into their shopping list; in the after-sale installed market, some original equipment(OE) tires with higher satisfaction scores will accordingly generate high customer loyalty, on the contrary, those with low satisfaction scores will cause negative influences, which demonstrates the reason why some tire brands with relatively high awareness occupation rate didn’t show up in the list of Top 10 brands of customer’s alternative. For tire manufacturers and auto enterprises, in the face of a more competitive market environment and consumers with more diverse needs, It’s of great help to increase customer satisfaction level if they keep enhancing product performance such as quietness and quality (including safety, durability and others), offering convenient maintenance service, and actively conveying customers clear instructions and maintenance information.

In the study of customer satisfaction with tire brands, it’s found that tire brands which have been originally equipped with a car from the factory can affect customers’ purchase decision, for they would put same configuration products into their shopping list; in the after-sale installed market, some original equipment(OE) tires with higher satisfaction scores will accordingly generate high customer loyalty, on the contrary, those with low satisfaction scores will cause negative influences, which demonstrates the reason why some tire brands with relatively high awareness occupation rate didn’t show up in the list of Top 10 brands of customer’s alternative. For tire manufacturers and auto enterprises, in the face of a more competitive market environment and consumers with more diverse needs, It’s of great help to increase customer satisfaction level if they keep enhancing product performance such as quietness and quality (including safety, durability and others), offering convenient maintenance service, and actively conveying customers clear instructions and maintenance information.

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission